Client Alert

New Mini-HSR Laws Take Effect This Summer

July 24, 2025

By Michael F. Murray, Catherine Kordestani, Cory Zayance and Bianca Londres

Starting Sunday, July 27, 2025, any party to an M&A transaction that triggers a federal Hart-Scott-Rodino (HSR) Act filing must also submit a copy to the Washington attorney general if the filing party (1) maintains a principal place of business in Washington or (2) generates in-state net revenues over certain thresholds. The Washington law adds a heightened notification requirement specific to certain healthcare transactions and amends the state’s existing healthcare premerger notification statute.

A similar law in Colorado goes into effect on August 6, 2025, but does not impact Colorado’s existing healthcare transaction law.

Washington and Colorado Lead

Both the Washington and Colorado laws are based on model 2024 antitrust legislation published by the Uniform Law Commission. Here are the key provisions of that legislation:

-

- Thresholds: Parties must file if their principal place of business is in the state or if they have annual in-state sales of at least 20% of the HSR minimum size of transaction threshold (currently $26.78 million worth of goods or services based on the current HSR threshold of $133.9 million, adjusted annually).[1]

- Notification: Parties must file a copy of the HSR form and additional documentary material with the attorney general.

Unlike the HSR Act, these state laws do not trigger a suspensory waiting period and there are no fees charged for filing. While significantly less than the HSR penalty[2], the penalties for noncompliance are $10,000 per day.

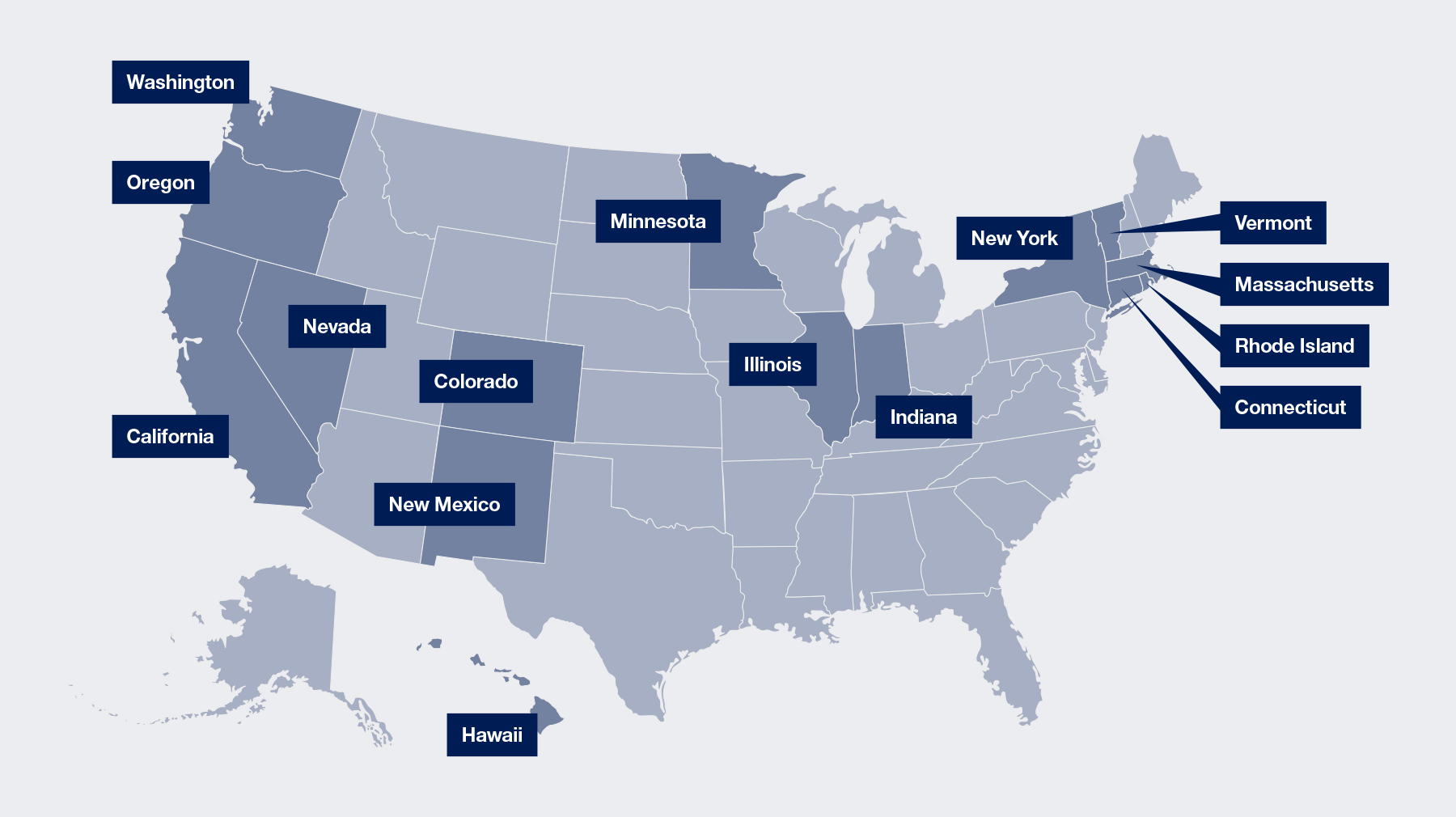

More states may follow Washington and Colorado. The California and New York senates passed similar legislation in June 2025 (although California’s bill comes with a filing fee and New York’s has some additional requirements as well). Similar bills are pending in Hawaii, Washington, D.C. and West Virginia but have failed to pass in Nevada and Utah. These state law developments occur against a backdrop of expanded federal reporting requirements, including Section 857 of the National Defense Authorization Act, which mandates concurrent filing with the Department of Defense for certain transactions.

States With Merger Reporting Regimes

|

Primary Transaction Notification Laws Last Updated July 11, 2025 |

||||

|

State |

Law/Code |

Thresholds |

Notification |

Timing |

|

California |

At least one party has annual healthcare revenues/assets ≥ $25 million for the past three fiscal years (or ≥ $10 million with a partner generating ≥ $25 million) or involves a health professional shortage area. |

Must notify California’s Office of Health Care Affordability of any transaction resulting in a “material change” in control/ownership of healthcare entities. |

90 days before closing. Parties can expect a 90-180 day delay until closing. |

|

|

Acquiring party must trigger HSR or acquire > 20 retail drug/grocery firms. |

Must notify California AG of a retail grocery firm or retail drug firm acquisition. |

180 days before closing. |

||

|

Colorado |

Hospitals meeting the 50% threshold. |

Must notify Colorado AG of a transfer of ≥ 50% of a hospital's assets. |

60 days before closing. |

|

|

Copy required if: b) The party has annual net sales in Colorado of ≥ 20% of HSR threshold (currently $126.4 million). |

Must send the Colorado AG a copy of the HSR form contemporaneously with filing HSR. |

No waiting period. |

||

|

Connecticut |

Applies to healthcare entities, including transactions where one party is a hospital, hospital system, or other healthcare provider triggering HSR. |

Must notify Connecticut AG of any material change in control involving hospitals or group practices. Separate post-closing notice to the state Office of Health Strategy also required. |

30 days before closing. |

|

|

Hawaii |

≥ 20% of a hospital in Hawaii. |

Must notify (and get approval) from the state Health Planning and Development Agency and AG for 20% ownership or a controlling interest in a hospital. |

90 days before closing. |

|

|

Illinois |

If all parties are Illinois-based, required. If an out-of-state party is involved, notice is required if that party generates ≥ $10 million in annual Illinois patient revenue. |

Must notify the Illinois AG for any merger, acquisition or affiliation involving healthcare facilities or provider organizations. |

30 days before closing. |

|

|

Indiana |

≥ $10 million in total assets and private equity firms acquiring Indiana health providers. |

Must notify Indiana AG if a “health care entity” involved in a merger or acquisition. |

90 days before closing. |

|

|

Massachusetts |

One of the providers/provider organizations must have had ≥ $25 million in annual revenue from payor reimbursements for patient care. |

Must notify Health Policy Commission of any material transaction involving a hospital or provider organization for a cost and market impact review. |

60 days before closing and cannot close until 30 days after the HMC issues its market impact report (if necessary). |

|

|

Minnesota |

≥ $80 million in revenues for large deals; $10 million to $80 million for smaller deals. |

Must notify Minnesota AG for certain healthcare transactions (including certain serial minor transactions). |

60 days for large deals; 30 days for smaller deals. |

|

|

Nevada |

Market share threshold. |

Must notify Nevada AG for certain transactions of healthcare providers or health insurers. |

30 days before closing. |

|

|

New Mexico |

Transactions involving New Mexico hospitals only. |

Must notify (and obtain approval) from New Mexico Office of Superintendent of Insurance hospital deals. |

120 days before closing. |

|

|

New York |

Deals that increase gross in-state revenues by ≥ $25 million. |

Must notify New York Department of Health of “material transactions” by healthcare entities. |

30 days before closing. |

|

|

Oregon |

One party has average revenue (nationwide) of ≥ $25 million in the last three fiscal years; other party has an average revenue of ≥ $10 million in the last three fiscal years (or last full year if new). |

Must notify (and obtain approval) from the Oregon Health Authority (OHA) for deals involving hospitals, health systems, insurers or large physician groups. |

180 days before closing; the OHA can expedite and “stop the clock” for incomplete filings or requests for information. |

|

|

Rhode Island |

Any ownership or control transfer of Rhode Island hospitals. |

Must notify the Department of Health (DOH) and the AG for any ≥ 20% acquisition of a hospital. |

30 days for notice, 180 days for final decision. |

|

|

Vermont |

Vermont-licensed hospitals and medical practices with one or more physicians. |

Must notify AG of acquisitions of hospitals and medical practices with one or more physicians. |

90 days before closing. |

|

|

Washington |

Wash. Rev. Code §§ 19.390.010 et seq.

|

For out-of-state entities, ≥ $10 million in revenue from Washington patients.

|

Must notify Washington AG for hospital deals, including provider organizations with ≥ seven providers. |

60 days before closing. Satisfied if need to send a copy under SB 5122 below. |

|

|

Copy of HSR required if: |

Must contemporaneously send HSR filing to Washington AG. |

No waiting period. |

|

Conclusion

Deal parties must be aware of these state-level filing requirements as they develop strategies to get their deal past regulatory review. The additional access to information may encourage state AGs to take a more active role in investigations, and experienced counsel is needed to navigate these evolving merger reviews. While the multifaceted enforcement landscape presents challenges, it also presents opportunities to advocate for procompetitive deals at both the state and federal levels.

[1] “To the extent that both the acquiring and acquired persons are required to report a transaction under the HSR, both persons might be required to file with the same AG if both persons fell within the coverage of this act.” Uniform Antitrust Pre-Merger Notification Act drafted by the National Conference of Commissioners on Uniform State Laws, dated September 16, 2024, available at Final Act with Comments_Antitrust Pre-Merger Notification Act_2024.

[2] The HSR civil penalty is currently $53,088 per day. This penalty amount is adjusted annually for inflation.

Contributors

Practice Areas

For More Information