Impact Investing

We work with investors focused on channeling investments to companies with the dual objectives of profit and purpose. We help our clients succeed by helping anticipate risk, acting on opportunities and measuring results. We combine legal prowess and business acumen with an understanding of responsible and sustainable investing objectives, and a culture of strong corporate social responsibility.

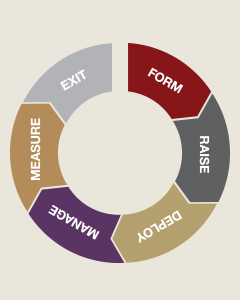

Our Work with Impact Investors

FORM – Advise on fund formation, structure, and corporate governance to promote and preserve mission, limit risk, and ensure economic returns.

RAISE – Guidance through regulatory framework to establish innovative capital raising and seed funding structures including financing and structuring traditional debt, equity, and program-related investments to incorporate mission.

DEPLOY – Due diligence on deal sourcing and selection, negotiation of investment structure with portfolio companies, and advise stakeholders on fiduciary issues, conflicts of interest, and other corporate matters.

MANAGE – Advise funds and their portfolio companies on operational and legal issues including performance expectations and measurement, asset and talent utilization, IP protection, data privacy and security, ESG diligence and risk, impact assessments of assets and value chains, and corporate governance matters.

MEASURE – – Integrate impact measurement and management, including sustainability and human rights reporting, and advise on the economic as well as ESG and sustainable investing criteria, policies and procedures.

EXIT – Advise on exiting or divesting an investment including trade sale, sale by public offering, write-off, restructuring, sale to another equity investor, or sale to a financial institution.

Client Successes

Represented Santander as Administrative Agent and Lead Arranger, BBVA Bancomer as Sustainability Agent and Lead Arranger and 9 other international banks in Fibra Uno’s $1.1 billion revolving credit agreement – the first loan in Latin America arranged in accordance with the Sustainability-Linked Loan Principles.

Advised responsAbility Investments AG on the $175 million microfinance securitization of which the proceeds will be used to fund financial intermediaries providing capital to 30,000 small businesses and 5.6 million microfinance borrowers, 81% of whom are women.

Advised Gabelli Funds LLC with respect to the creation of a mutual fund which pursues an investment strategy focusing on ESG investments.

Advised PIMCO with respect to international and domestic policies regarding ESG and sustainable investing criteria, including analysis of various global ESG initiatives and their application to global asset managers.

Advised Matthews Asia on the launch of Matthews Asia ESG Fund which seeks to invest at least 80% of its net assets in Asian companies that satisfy one or more its ESG standards.

Advised on the creation of the first enterprise fund in the Middle East, the U.S. Egyptian American Enterprise Fund, which invests in private enterprises in Egypt contributing to long-term inclusive and sustainable economic growth.

Client Alert

Federal Court Rules That Missouri Anti-ESG Rules are Preempted by Federal Law and are Unconstitutional

September 06, 2024

Client Alert

You Better Watch Out: A New EU Corporate Sustainability Reporting Directive is Seeing the Day

July 25, 2022

Client Alert

The Missing Piece to California’s Regulatory Puzzle for Accelerating Renewable Energy Development?

July 12, 2022

Client Alert

Commenters Respond to the SEC’s Proposed Rules on Climate-Related Disclosures

June 23, 2022

Partner, Real Estate Department

Partner, Corporate Department

Partner, Corporate Department

Partner, Employment Law Department

Partner, Corporate Department