Perspective

Bright Future Anticipated for Direct Lending Market Despite Impact of COVID-19

May 12, 2021

By

William Brady

& Tammy C. Davies

There is no doubt that the COVID-19 pandemic that began in 2020 delivered a far bigger shock to the economy than the financial crisis of 2007-2008, but what will be the short and long-term future impacts to the direct lending market? The outlook may be more positive than previous recessions would lead us to believe. This optimism is likely tied to the inherent dynamic of a private debt market that is often characterized as being flexible and offers creative financing solutions that are optimal for each circumstance and opportunity.

Optimists vs. Cynics:

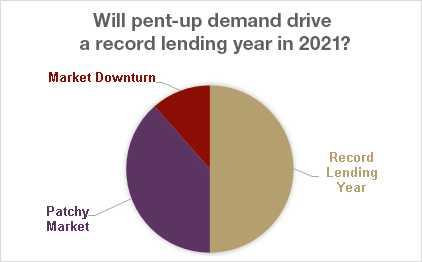

A recent poll conducted during a roundtable discussion at the Kayo Women’s Credit Summit indicated that 50 percent of industry leaders from across the private debt sector think that pent-up demand from 2020 will drive a record lending year in 2021. A further 38.5 percent believe that general uncertainty will result in a more patchy market, with fits and starts throughout the year. Only 11.5 percent foresee more cautionary investing as a result of lagging indicators from 2020, or believe that unforeseen factors will precipitate a market downturn.

Bucking expectations:

- Certainly, the market changes in 2020 and 2021 are proving very different from those that happened in 2008, which could be due to the record amount of liquidity in the market. Instead of a tightening, as many anticipated, the dry powder in direct lenders’ and private equity companies’ kegs has led to the market becoming competitive and highly unpredictable. The result is pricing and covenants that do not always align with a company’s financials. This trend was compounded by low rates in the high yield bond market, which restricted the options for lenders; however, while rates are starting to increase, the expectation is that this trend will continue in the near to medium term.

- The widely anticipated dramatic tightening of credit agreements in response to an increased number of business defaults due to a pandemic-generated recession simply did not happen last year. With the exception of sectors directly impacted by COVID-19, such as retail and hospitality, portfolios fared much better than expected and the market should continue to strengthen throughout 2021.

- Memories are short and, while the impact of the pandemic is leading to a greater attention to credit basics in the short term, those concerns will continue to fade as time passes. Right now, lenders need to ensure they understand the permutations of their loan documentation, particularly the lien and payment subordination provisions where there are multiple investors.

- The expected sharp elbows and more aggressive approach by lenders and sponsors to troubled credits has yet to materialize, particularly in the mid-market. One reason for this might be the more straight-forward capital structures, covenants, and documents, combined with the familiarity between the main players in the market, and the overall picture is one of supporting investments in distressed businesses to keep them afloat.

There is a consistent theme across the board from the lower-middle market all the way to the top; companies that were performing well pre-COVID-19 were supported by their lenders and able to negotiate accommodating terms; whereas, for companies that were already struggling, COVID-19 was the final straw. Businesses that can realistically expect to return to normal in six to twelve months have faced a far less hostile distressed investment environment than many would have imagined.

Towards a new normal:

Some sectors that have thrived during the pandemic could, paradoxically, face a downturn in their fortunes as the world recovers. Healthcare businesses, consumer products, food, paper goods, and cleaning products have done exceptionally well due to the pandemic, but this could be unsustainable long-term. These sectors will ultimately have a reset point and return to a more normalized performance level.

Industry sectors that were good performers pre-COVID-19 and that have performed steadily throughout the pandemic, such as insurance, technology, general healthcare, and housebuilding, maintenance, and DIY will continue to attract investors and remain incredibly competitive for the foreseeable future.

COVID-19 has shown us that the world is less predictable than we thought. Risk tolerance and underwriting sensitivities will reflect a broader spectrum of concerns in future. Chief among them for 2021 are commodity costs, particularly oil prices which are on the rise, and uncertainty surrounding the impact of the new presidential administration on industry sectors and the business environment.

While the overall picture for the next 12 to 18 months is positive, promising an active and strengthening market, the key take-away is that each deal will need to be assessed on its own merits. In terms of industry sectors, there have been some clear winners and losers, and there will be some shifts in fortunes as company performances across the board readjust to the post-pandemic world. Businesses, even within the same sector, have tackled COVID-19 challenges in different ways and with varying results, and lenders will not be able to treat companies within the same industry sector as homogenous.