Client Alert

The Future of Italian Mutual Banks

March 25, 2015

BY BRUNO COVA, PATRIZIO BRACCIONI, FLAVIO ACERBI & MARC-ALEXANDRE COURTEJOIE

Introduction

On March 24, 2015, the Italian Parliament converted into law an emergency decree[1] (the “Reform”) aimed at dramatically altering the legal framework applicable to Italian mutual banks or “banche popolari” (the “Mutual Banks”).

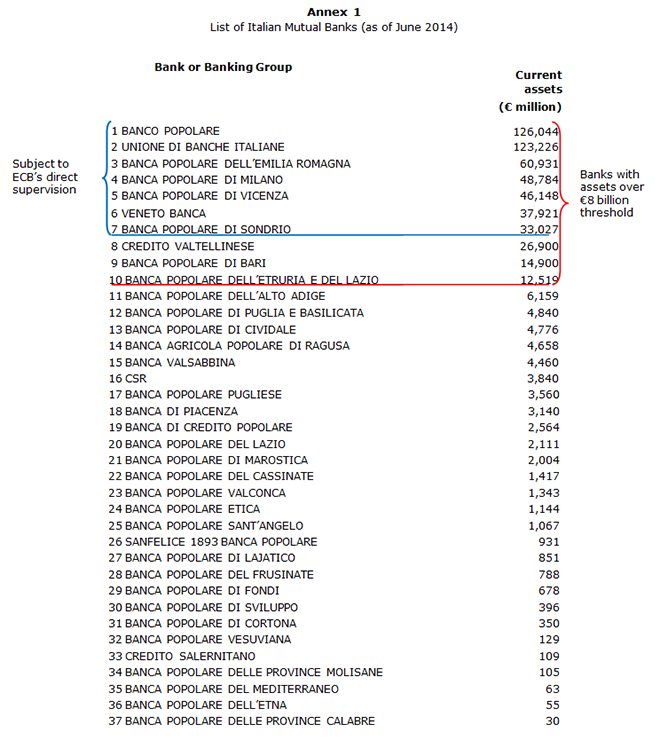

First and foremost, the Reform intends to force the biggest Mutual Banks with total assets exceeding €8 billion (on a sole or consolidated basis) to transform themselves into S.p.A.-type companies, i.e. joint stock corporations.

Secondly, the Reform amends significant aspects of the legal regime applicable to all Mutual Banks.

The Reform has been welcomed by regulators and commentators as an effective means to improve Mutual Banks’ corporate governance, encourage consolidation in the European banking sector, foster domestic as well as foreign investments, and eventually increase the competitiveness of the Italian banking system.

Mutual Banks

The Mutual Bank legal framework applies to a significant number of Italian banks, including listed companies and “significant supervised entities” subject to the direct supervision of the European Central Bank (the “ECB”) within the Single Supervisory Mechanism (a list of Italian Mutual Banks is attached herewith as Annex 1).

The Mutual Bank legal framework includes a set of specific rules that often proved an obstacle to investors, such as:

the “one head-one vote principle”, whereby shareholders are entitled to one vote only, regardless of the number of shares held;

a shareholding cap, limiting the number of shares that each shareholder is entitled to hold in a Mutual Bank (i.e., 1% or the lower cap provided for in the bylaws of each Mutual Bank);[2]

the shareholders’ admission process, whereby a shareholder is entitled to exercise voting rights only once (and if) “admitted” by the board of directors, although a shareholder is always entitled to exercise the economic rights pertaining to its shares (regardless of its admission);

limitations on proxy voting, whereby each shareholder is entitled to vote by proxy on behalf of maximum 10 other shareholders (or the lower limit set out in the relevant bylaws); and

limitation on distributions of dividends, whereby Mutual Banks have to set aside at least 10% of their annual net profits in a statutory reserve.[3]

Mandatory transformation into joint stock corporations

Following the enactment of the Reform, a Mutual Bank’s assets cannot exceed €8 billion (the “Threshold”), on a stand-alone or a consolidated basis.[4] Within a year from the date the Threshold is exceeded (the “Window-Period”), a Mutual Bank has to:[5]

pass a shareholders’ resolution relating to its conversion into a joint stock corporation (also by way of a merger) or its voluntary liquidation; or

reduce its total assets below the Threshold.

The Bank of Italy is expected to set out a thorough regulation of this matter in the next few weeks (the “Bank of Italy Regulation”).

In order to facilitate the transformation of the biggest Mutual Banks into joint stock corporations, the Reform introduces special majorities for any shareholders’ resolution relating to a Mutual Bank’s transformation (or merger into) a joint stock company[6] and simplified the authorization process.[7] Moreover, the Reform envisages an interim-regime, which provides:

an extension of the Window-Period applicable to Mutual Banks exceeding the Threshold as of the date of the enactment of the Reform (i.e., 18 months from the enactment of the Bank of Italy Regulation, instead of the 12-month Window-Period); and

an option to introduce, with the special majorities described above, a 5% (or higher) voting cap in the bylaws of Mutual Banks converted into joint stock corporations, expiring no more than two years after the date of the enactment of the Reform.[8]

Reform of the Mutual Banks’ legal regime

The Reform innovates Mutual Banks’ legal regime in several areas, without repelling its cornerstones (e.g., the “one head-one vote principle” and the shareholding cap). Among others, we highlight the following innovations:

option to issue special participation instruments: Mutual Banks may now issue special participation instruments, which may be entitled to economic as well as voting rights (e.g., up to 1/3 of all the voting rights in general shareholders’ meetings);

possible limitations on shareholders’ liquidation rights in case of withdrawal: the Bank of Italy may limit the rights of shareholders (and holders of special participation instruments) to have their shares redeemed in case of withdrawal, if it is necessary to include those shares in a Mutual Bank’s Tier 1 common equity. Pursuant to general rules of Italian corporate law, shareholders are entitled to withdraw from a company and have their shares redeemed in the context of specific events provided for under applicable law (e.g., in case of a transformation into another legal form) or otherwise provided for in a company’s bylaws;

higher number of votes that can be cast by proxy: the bylaws of a Mutual Bank have to set out the maximum number of votes that can be cast by proxy between a minimum of 10 to a maximum of 20;

multiple voting rights to legal entities: the bylaws of a Mutual Bank may provide legal entities with a right to cast up to five votes, in partial derogation to the “one head-one vote” principle; and

appointment of board members: Mutual Banks are no longer required to appoint a majority of the board of directors from “admitted” shareholders or individuals nominated by the “admitted” shareholders.

Comments

Mutual Banks have traditionally represented an important portion of the Italian banking business, with strong ties to local businesses. Their transformation into more “ordinary banks” will, on the one hand, attract the interest of foreign investors, which had traditionally no interest in them because of their peculiar features, and on the other hand, push them to seriously consider mergers as an option to strengthen their capital, improve their market position and competitiveness and be able to properly address the large volumes of new banking regulations.

In the meantime, with their transformation into joint stock corporations the biggest Mutual Banks will also probably experience a shift in the current power dynamics in the coming months and changes to their internal corporate governance.

The Reform is, therefore, expected to provide new investment opportunities for strategic investors, lenders, and equity and bond traders, increasing, at the same time, the efficiency of the Italian banking system.

***

[1] Law decree January 24, 2015, No. 3.

[2] The 1% shareholding cap does not apply to the shares held by undertakings for collective investment in transferable securities. Law decree October 18, 2012 No. 179 (converted into law December 17, 2012 No. 221) allowed Mutual Banks to provide a maximum 3% shareholding cap for so called “banking foundations” holding shares in excess of the 1% shareholding cap as of the date thereof, provided that any excess of the 1% shareholding cap originated from a consolidation process. The shareholding cap provided for in a Mutual Bank’s bylaws cannot be lower than 0.5%.

[3] Moreover, Mutual Banks have to donate to charity or for assistance purposes any net profits not otherwise allocated to reserves, distributed to shareholders or otherwise allocated pursuant to the bylaws.

[4] In case a Mutual Bank is a parent company of a banking group.

[5] In the event a Mutual Bank fails to take one of the actions described above before the end of the Window-Period, the Bank of Italy may take enforcement actions against it (i.e., prohibition of new transactions, propose to the Minister of Economy and Finance the “extraordinary administration”, the “interim management” or the mandatory administrative liquidation of the Mutual Bank or propose to the ECB the withdrawal of its banking authorization).

[6] The Reform sets out the following majorities: (i) on first call, 2/3 of the votes cast at the meeting, provided that at least 10% of the shareholders are present at the meeting; (ii) on second call, 2/3 of the votes cast at the meeting, regardless of the number of shareholders present at the meeting.

[7] Before the enactment of the Reform, any transformation of a Mutual Bank into a joint stock corporation (or a merger into a joint stock corporation) required a special authorization by the Bank of Italy, which had to be based on the “interest of the creditors”, “strengthening of the Mutual Bank’s assets”, or “consolidation of the system”. Following the enactment of the Reform any transformation of a Mutual Bank into a joint stock corporation is subject only to the general authorization process provided for any amendment to a bank’s bylaws and for any mergers and demergers involving a bank.

[8] Exception is made for the shares held by undertakings for collective investment in transferable securities.

Paul Hastings LLP

StayCurrent is published solely for the interests of friends and clients of Paul Hastings LLP and should in no way be relied upon or construed as legal advice. The views expressed in this publication reflect those of the authors and not necessarily the views of Paul Hastings. For specific information on recent developments or particular factual situations, the opinion of legal counsel should be sought. These materials may be considered ATTORNEY ADVERTISING in some jurisdictions. Paul Hastings is a limited liability partnership. Copyright © 2015 Paul Hastings LLP.